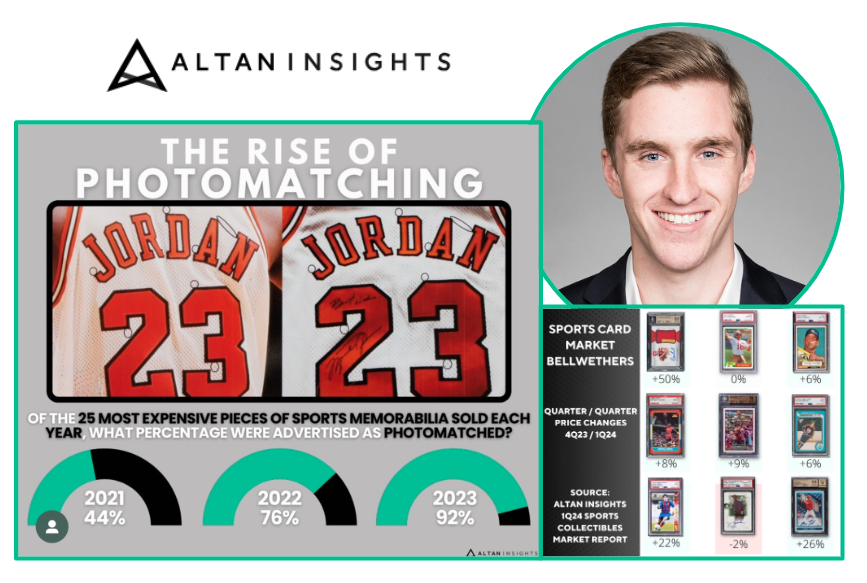

Dylan Dittrich is the Head of Research at Altan Insights and author of Sneakonomic Growth: Scarcity, Storytelling, and the Arrival of Sneakers as an Asset Class. He and his team provide data and quantitative analysis across more than 20 collectible asset classes, helping investors and collectors to make more informed decisions about how this fascinating market is evolving. In this Q&A, Dylan shines some light on some of Altan’s recent findings, how he got into the hobby and what we should expect moving forward.

Tell us about how you got into the collectibles sector and are you a collector of anything in particular?

Like many, I grew up collecting sports cards, and more recent reviews of that collection unfortunately confirm that it was definitely during the junk wax era! As a sports nerd, I also obsessed over jerseys. None of that stuff holds much - or any - value today, but the nostalgia that inspires so many collecting pursuits in adulthood is as potent as ever.

As an adult, I fell back down the collectibles rabbit hole through sneakers. A more casual interest in high school and college became a much more active one in my early-to-mid-twenties, which coincided with the rise of popular resale platforms like StockX and GOAT. I was incredibly fascinated by the idea that a product was never truly "sold out" and that market forces could shape true market pricing.

At the time, I was in the traditional investment world, and I was struck by how similar some of these market forces were to what I was seeing in my day job. So, I set out to write a book called Sneakonomic Growth about the economy created by sneaker collecting, which became a fun exploration of the way people would pursue their passions through entrepreneurship.

Ever since, I've been hooked on the process of learning about countless other markets of things, their similarities, and their differences.

With many changes taking place across the hobby over the last few years, from Set Registries to photomatching and numerous mergers and acquisitions, what do you think has had the biggest impact on the evolution of the hobby and collecting more generally? What do you see having the biggest impact in the years ahead?

Perhaps some Altan bias here, but the greater availability of data has been a significant development to date, with opportunity for significant impact going forward. Hobby conversations that were previously grounded in mostly anecdotal evidence and recency bias can be supported and elevated with data. That can impact collecting decisions, consignment decisions, marketing decisions, and even production decisions. All of those choices can be made more intelligently through the use of actionable data.

Despite various significant advances in hobby markets in recent years, these markets are still relatively inefficient. But the more decisions are supported by data, the more efficient they'll become. From asset-level sales data to industry-level volume data to population data, the collectibles world is in the most transparent place it's ever been, and we think the demands of various constituents throughout the industry will continue to drive increased transparency through data.

Earlier this month, we saw a Caitlin Clark rookie card sell for $10K, which is a reflection of the heightened interest around women's sports in recent years. Do you expect to see female athletes playing a bigger role in the hobby moving forward?

We've been following the trend in women's sports very closely. The events of 2021 and 2022 proved to be a false start in the category, and like many parts of the sports card market, exuberance was ultimately reversed as quickly as it arrived.

Mia Hamm's Sports Illustrated for Kids card set the female sports card record in June of 2021 at $34,440. Less than a year later, it had been broken five times (by a Serena Williams card each time), and the record stood at $263,200. By November of 2022, the same card that set the $263,200 record sold again for $39,600. The rise in the market was almost entirely confined to Serena, though a brief spike in Naomi Osaka interest proved exceptionally painful on the way down.

That speculative rise proved unsustainable, but there's an argument to be made that the rising interest in women's sports could cultivate a new, authentic audience of engaged collectors and that some existing collectors might develop an authentic interest in stars with broad cultural appeal. With what we saw this March, Caitlin Clark appears to be that kind of star. The $78,000 sale of her 1-of-1 Superfractor Auto was the highest price for a women's card since June of 2022 and would've been double the record in 2021. But Clark will have to sustain her box office appeal in the WNBA for this recent surge in her card prices to be more than a flash in the pan.

It might be unrealistic to expect that female sports card prices will broadly rise to parity with men's cards tomorrow, but there's reason to be optimistic that a new foundation for collectability is forming that can rise with the general interest in women's sports. Similarly, standout stars in women's sports with strong cultural appeal can command strong demand commensurate with their relevance to a broad audience.

The 2024 Summer Olympics will be kicking off in Paris in late July. Although Olympic memorabilia is not as prevalent across the hobby, has Altan noticed any sort of uptick in Olympic-related collectibles in an Olympic year? Are there any Olympic items that the Altan team has seen that have really caught your attention?

Historically, the Olympic items generating the most buzz and the highest prices have been those from mainstream sports like basketball and hockey. This makes sense - it's where traditional collectors are most comfortable, and the athletes' cultural relevance needs no further validation.

Beyond those sports, though, the Olympics is really about creating memorable moments of global inspiration. We've seen torches and medals sell for large sums in the past, but we haven't seen broad Olympic activity start to ramp up just yet this year. With the Trials approaching for several sports next month and the Games just a few months away, we'd expect to see more attention in coming auction events. Looking even further ahead, the Olympics in Los Angeles in 2028 should be a significant driver of activity.

Most of what has been sold to date - outside of the Miracle on Ice and Dream Team memorabilia - hasn't drawn that nostalgic connection to a specific memorable event. You wonder what might find its way to market from some of the biggest icons the Games have ever seen - Usain Bolt, Michael Phelps, Simone Biles. Usain Bolt's spikes or singlet from his 100 meter gold medal in Beijing would be all-time items. The image of him celebrating before hitting the finish line looms large in memories worldwide.

Altan Insights has become one of the leaders in data and analysis around the collectibles market. What have been some of the most interesting data points you've uncovered that help paint a picture of where the market is heading and how it fits into the broader alternative investment landscape?

We started producing our Sports Collectibles Market Reports at the start of 2022, which proved to be a fascinating time to get started. Obviously, the card market, particularly in modern, was in the late stages of its meteoric rise at that point. But studying the nuances of the market in this period can be quite revealing. Within any market, there are pockets that react differently in different moments.

For instance, there's the relative resilience of vintage markets. In the first quarter of 2023, six-figure auction sales of sports collectibles were down 23% year-over-year. But the number of six-figure vintage sales was actually up. That's a trend we've seen fairly consistently - not necessarily the growth, but the stronger relative resilience. The pullback in sports collectibles markets broadly has really been a modern-driven phenomenon. It speaks to the composition of buyers in each category: modern saw significant speculative activity in 2021 and early 2022, while vintage appears to be comprised of a greater proportion of longer-term, pure collectors.

Trends in game-worn and used memorabilia have also been interesting to follow. While growth slowed in 2023, zooming out shows you just how far that market has come in two years. The top 25 game-worn sales in 2023 more than doubled the number achieved in 2021. That shows the extent to which record sales in 2022 contributed to a market that really retrenched at higher levels in the months to follow. Many museum-quality artifacts are taking to prices previously reserved for the fine art world, which is indicative of evolving tastes among UHNW (ultra-high net worth) collectors.